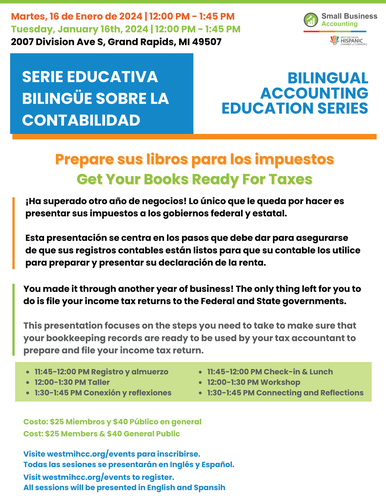

Bilingual Accounting Education Series: Get Your Books Ready for Taxes

Name:

Bilingual Accounting Education Series: Get Your Books Ready for Taxes

Date:

January 16, 2024

Time:

12:00 PM - 1:45 PM EST

Registration:

Register Now

Event Description:

You made it through another year of business! The only thing left for you to do is file your income tax returns to the Federal and State governments. This presentation focuses on the steps you need to take to make sure that your bookkeeping records are ready to be used by your tax accountant to prepare and file your income tax return.

¡Ha superado otro año de negocios! Lo único que le queda por hacer es presentar sus impuestos a los gobiernos federal y estatal.

Esta presentación se centra en los pasos que debe dar para asegurarse de que sus registros contables están listos para que su contable los utilice para preparar y presentar su declaración de la renta.